AI chip Curbs: In the global race for technological dominance, recent U.S. efforts to restrain China’s progress through chip export controls are starting to show unintended consequences. Instead of slowing China down, these moves appear to be pushing it forward—while American companies like NVIDIA are left to deal with the fallout.

Export Controls: Strategy with Side Effects

The U.S. government began implementing restrictions on the export of high-end semiconductors several years ago. The main goal was to prevent advanced technology from being used for military purposes by foreign powers and to maintain America’s leadership in the industry.

However, according to industry insiders, the policy may be doing more harm than good.

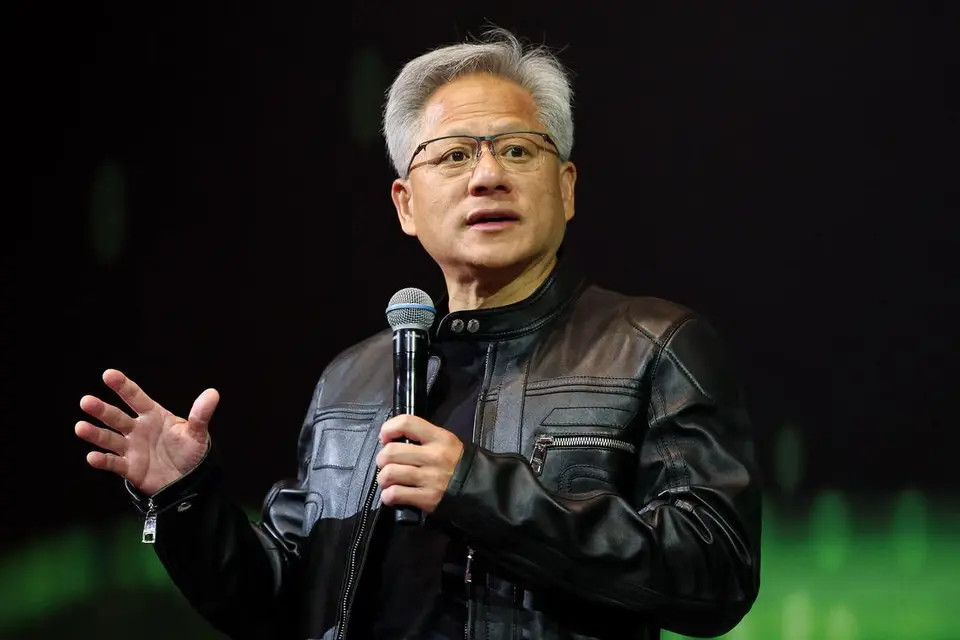

NVIDIA’s CEO, Jensen Huang, did not mince words recently at the Computex tech conference in Taipei. He called the current export strategy a “failure” and explained that these policies have damaged American companies more than their intended target. Huang revealed that NVIDIA’s market share in China has plunged from 95% to 50% over the past four years due to tightening restrictions.

China Responds with Speed and Strategy

While U.S. policymakers hoped to maintain a technological edge, China has instead accelerated its development efforts. Industry analyst Ray Wang, who tracks developments between the two nations, said the export curbs have had an unexpected effect: they’ve inspired a burst of innovation across Chinese tech sectors.

In response to being cut off from foreign suppliers, Chinese companies have ramped up their investment in local manufacturing, design, and research. Big names like Huawei are now creating their own alternatives, while startups are mushrooming to fill the gaps. Companies like DeepSeek have made impressive strides, gaining international attention and challenging the dominance of long-established Western firms.

NVIDIA Takes a Financial Hit

For NVIDIA, one of the world’s top chip designers, the cost of these restrictions is massive. The company recently reported a $5.5 billion loss in expected revenue due to the latest round of U.S. rules that block the sale of its H20 chips to Chinese clients.

These H20 processors were developed specifically to meet previous U.S. requirements, but newer restrictions rendered them ineligible for export. Analysts now estimate that NVIDIA has lost over $15 billion in total sales because of the ongoing policy changes.

Such financial hits are concerning—not only because of the lost income but also because they hinder NVIDIA’s ability to reinvest in new technologies and maintain its competitive edge.

China’s Push for Self-Sufficiency Gets a Boost

The AI chip curbs have also had a significant political and economic impact within China. Far from relying on outside help, the Chinese government has funneled billions into building a self-sustaining chip ecosystem. This includes everything from raw materials and manufacturing to research and development.

Paul Triolo, Senior VP at DGA Group, believes that the export controls have played right into China’s long-term plans. “Instead of weakening the local industry, they’ve actually reinforced the need for China to stand on its own two feet,” Triolo said.

He further explained that the policy shift has helped give rise to future competitors who are now developing their own advanced chip technology—essentially building a rival industry with global ambitions.

Constantly Shifting Rules Spark Concern

One of the major criticisms of the U.S. approach is its lack of consistency. From 2019 to the present, rules have been revised and expanded several times, leaving companies unsure of how to plan for the future.

According to Triolo, this constant “moving of the goalposts” has created significant uncertainty. The lack of a clearly defined endgame makes it difficult for U.S. businesses to make long-term decisions, particularly when they risk losing access to one of the world’s largest markets.

The Information Technology & Innovation Foundation (ITIF), a respected U.S. think tank, has also voiced concern. In a recent statement, ITIF called the current policy ineffective and warned that it could backfire even further if left unchanged.

Stephen Ezell, a senior analyst at ITIF, noted: “It’s understandable to keep military technology out of the hands of potential adversaries. But cutting off American companies from the entire Chinese commercial market is excessive—and damaging.”

What’s Next for U.S. Tech Giants?

As China grows more independent in chip production, the dynamic is shifting. Once viewed mainly as a customer, China is now emerging as a global competitor in the chip space.

This development puts added pressure on American companies to innovate faster while being locked out of a major market. It’s a lose-lose scenario where U.S. firms struggle financially, while Chinese firms grow stronger and more self-reliant.

The road ahead is unclear. Unless there is a major rethink in strategy, the AI chip curbs may continue to backfire—pushing China toward greater independence, while hurting the very companies they were meant to protect.