Introduction to PhonePe and its journey so far

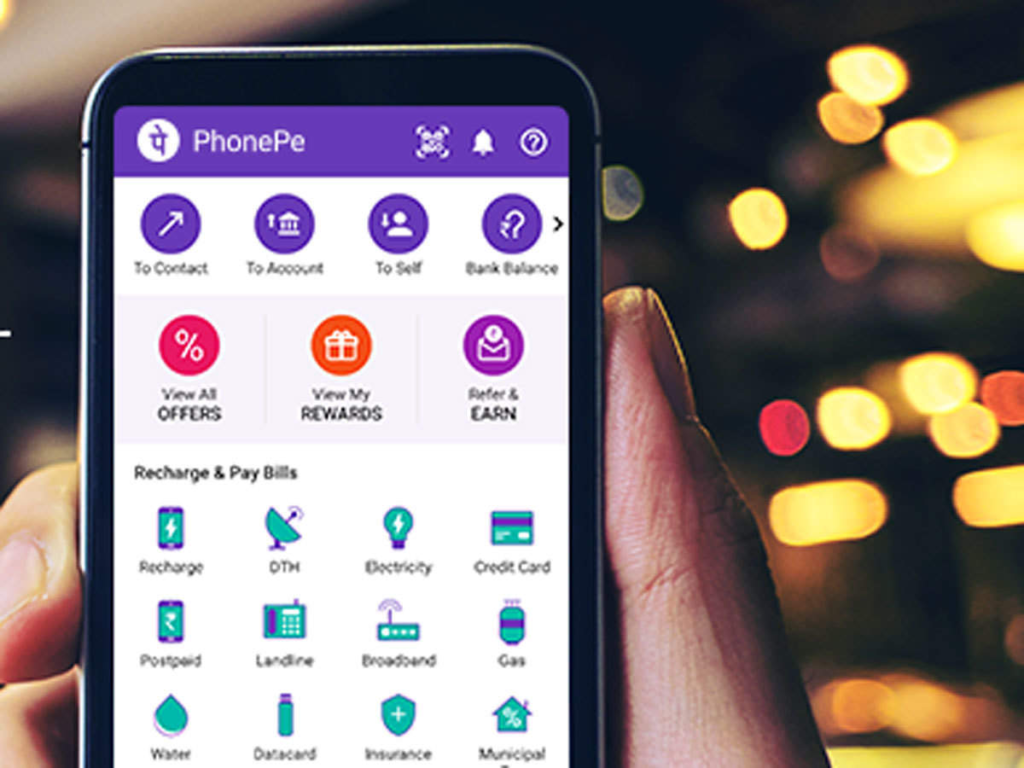

In the bustling landscape of Indian fintech, few names resonate as strongly as PhonePe. Launched in 2015, this digital payment platform quickly became a game-changer in how people transact across the country. From facilitating peer-to-peer transfers to enabling bill payments and merchant transactions, PhonePe has transformed everyday financial interactions into seamless experiences. But like any success story, its journey has been dotted with challenges and obstacles.

As competition intensified and market dynamics shifted, PhonePe faced several hurdles in its quest for profitability. Yet through careful planning and innovative strategies, it has emerged stronger than ever before. Let’s delve into how this formidable player navigated the complexities of the Indian market, embraced new opportunities amidst adversity, and ultimately achieved impressive revenue growth while redefining digital payments for millions of users across India.

The challenges faced by PhonePe in the Indian market

PhonePe has navigated a complex landscape in the Indian market. The fintech sector is fiercely competitive, with players like Paytm and Google Pay vying for dominance. This rivalry intensifies pressure on pricing strategies and user acquisition.

Regulatory hurdles have also posed significant challenges. Compliance with evolving norms can strain operational efficiency and increase costs. For startups, adapting quickly to these changes is crucial but often daunting.

Moreover, consumer trust remains a critical factor. Users are cautious about digital transactions due to concerns over security and privacy. PhonePe needed to invest heavily in building its reputation as a reliable payment platform.

Additionally, infrastructure gaps in rural areas complicate expansion efforts. Internet connectivity issues limit user engagement outside urban centers where smartphone penetration is higher. Addressing these barriers requires innovative solutions tailored to diverse customer needs across India’s vast geography.

The strategies implemented by PhonePe to turn profits

PhonePe adopted a multi-faceted approach to transform its business model and achieve profitability. One key strategy involved diversifying its offerings beyond just digital payments. By expanding into financial services such as insurance, lending, and investment options, Phone-Pe tapped into new revenue streams.

Moreover, the platform focused on enhancing user experience through seamless integration of features. Simplified interfaces and faster transactions helped retain customers while attracting new users to the app.

Cost management played a crucial role in this transformation. Streamlining operations allowed Phone-Pe to reduce overheads without compromising service quality.

Strategic partnerships also bolstered growth. Collaborations with banks and businesses expanded their market reach significantly, increasing brand visibility across various sectors.

Investing in technology has been another cornerstone of their strategy. Leveraging data analytics enabled smarter decision-making and personalized marketing efforts that resonated with users’ needs.

Key factors contributing to the success of PhonePe

PhonePe has emerged as a leader in the Indian fintech landscape, driven by several key factors.

First, its user-friendly interface makes transactions seamless for users of all ages. This accessibility has significantly broadened its customer base.

Second, robust partnerships with various merchants and service providers have enhanced Phone-Pe’s market presence. Collaborations with banks and e-commerce platforms have further solidified its foothold.

Moreover, innovative features like bill splitting and instant money transfers cater to evolving consumer needs. These functionalities set it apart from competitors.

Cost management plays a critical role too; efficient operations enable better pricing strategies that attract more users without sacrificing quality.

Aggressive marketing campaigns effectively promote brand awareness while enticing new customers to explore digital payments. The combination of these elements drives PhonePe’s impressive financial performance and solidifies its position in the competitive payment ecosystem.

The impact of the COVID-19 pandemic on PhonePe’s business

The COVID-19 pandemic reshaped the Indian fintech landscape, and PhonePe was no exception. As lockdowns forced consumers to shift from cash transactions to digital payments, Phone-Pe’s user base surged dramatically.

This sudden increase in demand led to a spike in transaction volumes. Many businesses turned online, seeking reliable payment solutions. PhonePe capitalized on this trend by enhancing its platform’s usability and security features.

However, challenges emerged too. The economic downturn affected many merchants who struggled with reduced sales. Despite this, Phone-Pe managed to adapt its strategies swiftly, offering incentives for both users and merchants.

The company’s focus on cost management allowed it to navigate these turbulent times effectively. By streamlining operations and optimizing resources, PhonePe maintained steady growth amidst uncertainty while reinforcing its position as a leading player in the digital payments sector.

Future plans for growth and expansion

PhonePe is poised for ambitious growth as it sets its sights on expanding beyond traditional digital payments. The company is exploring opportunities in financial services, including lending and insurance products. By diversifying its offerings, PhonePe aims to capture a broader customer base.

International expansion is another key focus area. Entering new markets will allow Phone Pe to leverage its successful business model while adapting to local payment ecosystems. This strategy could enhance market share significantly.

The development of innovative features is also on the horizon. Enhancements in user experience and security measures are priorities that will keep customers engaged and confident in using the platform.

Moreover, partnerships with banks and fintech firms can provide synergies that drive revenue growth. Collaborations will help PhonePe tap into existing infrastructures and accelerate adoption rates among consumers globally.

Conclusion: PhonePe’s success story and its role in revolutionizing digital payments in India

PhonePe’s journey in the Indian fintech landscape has been nothing short of remarkable. Starting as a digital payment platform, it has grown into a dominant player with significant market share. The company’s ability to shift from losses to profitability is a testament to its robust financial strategy and effective cost management.

By overcoming various challenges, including intense competition and regulatory hurdles, Phone Pe has established itself as an essential part of India’s digital payments ecosystem. Its innovative business model focuses on user engagement and diversified services, positioning it well for sustained revenue growth.

The impact of the COVID-19 pandemic accelerated the adoption of digital transactions, allowing Phone Pe to capitalize on emerging trends in consumer behavior. This momentum not only boosted their earnings but also set new profitability milestones.

Looking ahead, PhonePe’s commitment to growth will undoubtedly shape the future of digital payments in India. As it continues to innovate and expand its offerings, one thing remains clear: Phone Pe is more than just a payment platform; it’s at the forefront of revolutionizing how millions transact every day in India’s evolving economy.

For more such content, keep visiting QAWire