The Finance Minister of India, Nirmala Sitharaman, presented the Union Budget 2025-26 on February 1, marking the first full-fledged budget of the Modi 3.0 government. This budget is centered around transformative reforms across taxation, urban development, agriculture, technology, and financial sectors. It aims to provide economic stability, growth, and support for middle-class families while strengthening India’s position in global markets.

1. Major Income Tax Reforms in Budget 2025-26

One of the most anticipated announcements in the Budget 2025-26 was the revision of the income tax structure, aimed at reducing the tax burden on the middle class. The tax exemption limit has been raised to ₹12 lakh per annum, up from ₹7 lakh, offering significant relief to salaried individuals. Additionally, the standard deduction has been increased to ₹75,000, effectively making incomes up to ₹12.75 lakh tax-free.

The new tax slabs are as follows: ₹0-₹4 lakh (nil), ₹4-₹8 lakh (5%), ₹8-₹12 lakh (10%), ₹12-₹16 lakh (15%), ₹16-₹20 lakh (20%), ₹20-₹24 lakh (25%), and above ₹24 lakh (30%). Furthermore, the deduction limit for senior citizens has been doubled, providing them with additional tax relief. These measures are expected to increase disposable income, boost consumer spending, and stimulate overall economic growth.

In the 2024-25 budget, the government had already made strides in simplifying the tax system, offering initial relief to individuals with a ₹7 lakh exemption limit.

2. Focus on Agriculture and Rural Development

To support farmers and enhance agricultural productivity, the Budget 2025-26 introduced several key initiatives. A new urea plant in Assam aims to boost fertilizer production and reduce import dependence. The High-Yield Seed Mission focuses on improving seed quality to increase crop yields. The Five-Year Cotton Productivity Mission is designed to enhance cotton farming through advanced techniques. The PM Dhan Dhyan Krishi Yojana targets districts with low agricultural productivity to stimulate growth. Additionally, the Modified Interest Subvention Scheme will offer farmers increased credit access at lower interest rates. These initiatives are set to modernize agriculture, ensure food security, and increase farmers’ incomes, aligning with the government’s goal of sustainable agricultural growth.

3. Investment in Infrastructure and Urban Development

The Budget 2025-26 continues to emphasize infrastructural growth and urban modernization. The government has allocated funds for the expansion of smart cities, aiming to add 50 more to the existing list. To support homeownership, subsidies and incentives under the Affordable Housing Scheme will help the middle class and economically weaker sections purchase homes. The metro rail network will also be expanded to Tier 2 and Tier 3 cities, improving public transportation. These initiatives are set to enhance urban living conditions and drive economic development through a well-planned infrastructure push, aligning with the government’s long-term vision for urban modernization.

4. Technological and Scientific Advancements

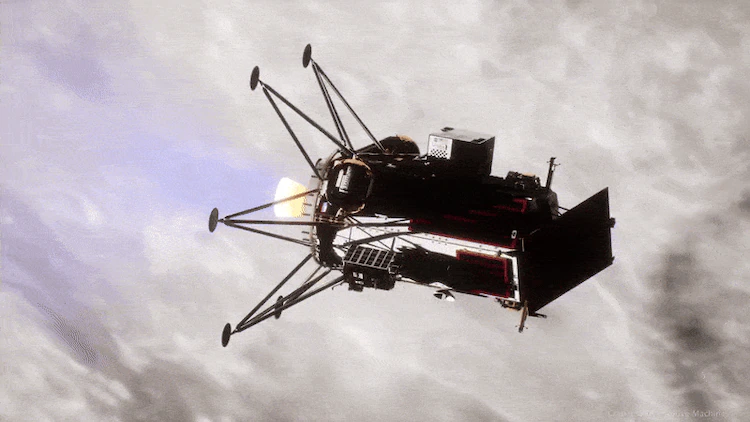

The Budget 2025-26 has allocated significant resources for technological innovation and scientific research. ₹600 crore has been allocated to the Deep Ocean Mission under the ‘Samudrayaan’ project, focusing on exploring ocean depths for research and deep-sea mining. Investments have been made to expand semiconductor manufacturing in India, reducing reliance on imports. Additionally, more funds have been directed towards AI-based startups and improving digital infrastructure. These initiatives aim to position India as a leader in scientific innovation and digital transformation.

In the 2024-25 budget, the auto component industry faced challenges due to a lack of clarity on policy incentives and support for green technology adoption. However, the 2025-26 budget addresses these issues by introducing clearer policies and financial support, helping the industry transition towards more sustainable production methods and boosting its global competitiveness.

5. Financial Sector and Regulatory Reforms

The budget 2025-26 introduces new policies for the financial sector aimed at boosting growth and inclusivity. Steps have been taken to simplify the GST process, reducing the compliance burden on small businesses. Tax incentives for startups and small enterprises have been extended to encourage entrepreneurship. Additionally, banking reforms will strengthen public sector banks and enhance digital payment infrastructure. These reforms are expected to attract foreign investment and promote financial inclusivity across the country.

6. Fiscal Deficit and Economic Growth Projections

The fiscal deficit for FY 2025-26 is projected at 4.8%, reflecting the government’s commitment to balancing growth with financial discipline. Capital expenditure has been increased to ₹10.18 lakh crore, with a focus on infrastructure and technology. Total revenue receipts are estimated at ₹34.96 lakh crore, while expenditure is projected at ₹50.65 lakh crore. Despite the significant spending push, the government remains focused on maintaining fiscal consolidation.

7. Public Reactions and Expert Opinions

The budget 2025-26 has received mixed reactions. Middle-class families and salaried professionals have welcomed the income tax relief, which eases their financial burden. Farmers and agricultural experts have praised the focus on improving seed quality, boosting fertilizer production, and providing financial assistance. However, economists have cautioned that while the increased spending is necessary for growth, maintaining fiscal discipline will be crucial for ensuring long-term economic stability.

Conclusion: A Balanced and Growth-Oriented Budget

The Union Budget 2025-26 strikes a balance between tax relief, economic growth, technological advancements, and fiscal prudence. With a strong focus on middle-class support, agricultural growth, infrastructure expansion, and technological innovation, the government aims to create a self-reliant and progressive India. The success of this budget will largely depend on how effectively these policies are implemented in the coming years.